For years, technology leaders have been losing the war on technical debt. The statistics are bleak: McKinsey states that 60% of CIOs report their debt is growing, and 97% underinvest in remediation, often spending over 20% of project budgets simply managing debt-related complexity — the “interest payments” on a spiraling principal.

It’s time to acknowledge the hard truth: the arguments for risk mitigation have ultimately failed, not because the technical case is unsound, but because the business case is structurally flawed. Statistics show that enterprises don’t care enough to fund tech debt remediation initiatives, and that is unlikely to change anytime soon.

Before we figure out what to do next, it is important to understand why technical debt has failed to drive business investment.

Shifting From Risk To Opportunity

While many IT professionals want to invest more time and effort into metrics and quantification of the problem under the belief that “making the impacts more transparent and quantifiable will push enterprises into action,” this ignores the real culprit. The team at McKinsey recommends leaning into more quantification, but the industrywide failure to progress seems to indicate that this recommendation has lost the plot.

The lack of business interest has nothing to do with tech debt “not being fully quantified.” It’s grounded in how opportunity cost-dynamics combine with budget planning cycles and the typical lifespan of middle and upper management within a modern enterprise.

This acknowledgement does not mean that IT should give up on modernizing IT portfolios. Instead, it points to the need for a fundamental shift in tactics. If the value proposition of addressing the “IT’s hair is on fire!” problem has failed, a new avenue seems to have opened with a once-in-a-lifetime opportunity for asymmetric returns on the line.

The shift from technical debt (risk) to asymmetric growth (opportunity) is not a rhetorical trick to address the culture of short-termism; it’s an urgent financial imperative that has the necessary appeal to generate executive-level support from across the enterprise.

The Alignment Gap: Stop Selling Vegetables

The perennial failure of technical debt conversations stems from a profound misalignment with enterprise budget cycles. IT leaders frame debt remediation in terms of long-term risk avoidance, but finance and business executives are rewarded for short-term gains, immediate feature delivery, and cost savings.

This dilemma has gained visibility with mainstream technology leaders in the last few years; so much so that Gene Kim (founder of IT Revolution Press and author of best sellers like The Phoenix Project, The DevOps Handbook, and the recently released Vibe Coding with Steve Yegge) invited me and David Rice, SVP of Technology at Cox Automotive, to the main stage at this year’s ETLS conference for a fireside chat to help the wider IT community get more connected to the crux of the problem.

Technical debt is functionally invisible to non-technical stakeholders until the entire system collapses. When the choice is between abstract, future consequences and concrete, immediate feature delivery, the decision is always the shortcut, by default.

This is why, when a project includes debt remediation, financial leaders inevitably ask: “Is there any way to deliver the new capabilities without retiring the technical debt?”

To break this cycle, technology professionals must stop using the language of logic and technical righteousness. Instead, lean into the core lesson for securing budget.

It’s simple: sell what they want to buy, not what you want to fix.

We often resemble frustrated parents preaching to children about the long-term health benefits of broccoli. The solution, learned by savvy parents and IT leaders alike, is to pivot the conversation to what the decision-maker cares about — which is not health, but growth.

This insight is best illustrated by a personal parenting anecdote: “Frankenstein french fries.”

When my children were little, I quickly learned that they didn’t care about the long term health value of eating vegetables. Instead, I got them to eat green beans consistently by renaming them to sound fun and interesting, thereby tapping into their motivation (novelty and silliness) rather than lecturing about concepts they had no interest in. Similarly, IT must stop selling debt retirement and start speaking the language of low-risk, high-reward opportunities: asymmetric growth.

The Language of Growth: Convex Optionality

The alternative to the failing technical debt argument is the strategic generation of optionality — the systematic practice of “having the right to engage in many different options with no obligation to pursue any of them.”

When the future is uncertain — as it is today — optionality becomes more than a survival mechanism.

Leaders from enterprises in financial services and digital platforms know that optionality is a golden ticket opportunity that opens the door to organic growth and windfall opportunities that do more than cut costs and increase agility. This is why the financial model of convex optionality is so compelling to the C-suite: it represents investments characterized by low incremental cost (small bets) and high, uncapped potential gain (asymmetric payoffs).

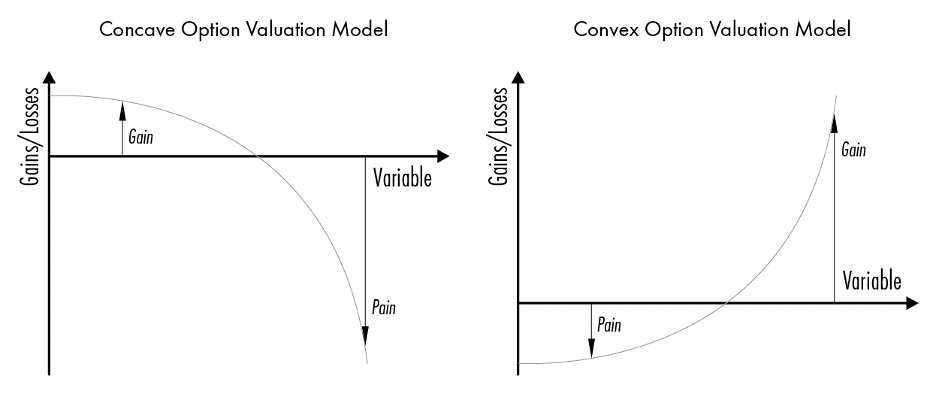

When the cost to generate and maintain an option is high but the potential gain from exercising it is low, that option is said to be concave. Conversely, when the cost to generate and maintain an option is low but the potential gain is high, that option is said to be convex.

Source: Nassim Nicholas Taleb, Antifragile: Things That Gain from Disorder. New York: Random House, 2014: 273.

The goal of the enterprise should not be risk mitigation (a concave investment with capped returns as shown above on the left) but maximizing the potential for asymmetric growth (a convex investment as shown above on the right).

Sell What Your Stakeholders Want to Buy: Funding Technical Credit Through AI

To compel the necessary architectural pivot, IT needs an irresistible catalyst — a topic the C-suite is already eager to fund due to its potential for asymmetric return. That catalyst is artificial intelligence.

Prior to the arrival of vibe coding, development was slow enough that you could clear debt-related decisions and mistakes within two years.

Now, those same two years of AI-accelerated development (layered onto fragile, non-modular systems) have the potential to create 20 years’ worth of technical debt — and there’s no path to escape those consequences other than to use more AI-accelerated development, creating an unending trip on the debt merry-go-round (that is anything but merry).

This realization transforms the funding conversation.

Instead of proposing to fund “technical debt clean-up” (a cost of avoidance), IT can propose funding options ranging from “AI preparedness” to any concrete AI initiative that, just like the mobile wave in the 2010s, will inevitably require investments in data management, integration, and API management.

In another similarity to the mobile wave, the increased appetite from business and executive stakeholders won’t be because of bulletproof ROI quantification, but because of a zeitgeist moment with a massive asymmetric opportunity that they already believe is here.

The Architectural Dividend: Creating Technical Credit

If technical debt measures inertia, technical credit measures adaptability.

Technical credit is the direct counter-concept to technical debt. Technical credit refers to the benefit resulting from strategic design decisions that, while in some circumstances requires a slightly higher initial investment, enable cost-effective future adaptations.

The architectural requirements for successful, scalable, and trustworthy AI adoption are precisely the prerequisites for generating technical credit:

| AI Investment Requirement | Technical Credit Outcome |

| Decomposed Capabilities (APIs) | Modularity and Optionality: AI agents require modular, action-oriented APIs to prevent the system from being locked into a single application context. This loose coupling lowers the cost of future change, accelerates debt remediation (because parts are easier to swap), and slows the accumulation of new debt. |

| Robust Integration Platform | Platform Resilience: Rapidly integrating new AI models requires a resilient platform. Investments in resilience patterns like circuit breakers guard against cascading failures, ensuring the platform is “resilient by design” and amenable to evolution. |

| Clean, Trustworthy Data | Data Optionality: AI models demand high-quality, governed data feeds. Investing in clean data pipelines generates data optionality, removing friction and accelerating the creation of new AI services [User Query]. |

By framing AI’s uncapped potential as the intended outcome and architectural hygiene as the infrastructure required to achieve this outcome, IT shifts the conversation from avoiding IT catastrophe to seizing business opportunity. The investment in AI funds the architecture that inherently generates technical credit, ensuring the organization is structured to gain from disorder and uncertainty rather than suffer.

The strategy is clear: stop campaigning against legacy burdens that have not yielded any substantial or sustainable business interest. Instead, position asymmetry as the center of possibility and leverage the irresistible imperative of AI to fund the architectural future the enterprise should have been building all along.

Join us December 2 at 12pm ET for a complimentary two-hour hands-on virtual workshop to discover how Boomi empowers you to build enterprise-ready AI agents. Register here.

English

English 日本語

日本語